BLOG

The cost component split and cost component views provide valuable insight into a cost estimate. Setting up cost components correctly leads you to a multi-faceted understanding of cost estimates.

At the beginning of our implementation, the priority was to develop standard costs, and we inadvertently ignored additional information easily available with cost component views.

You define a cost component with transaction OKTZ as shown in Figure 1. Several settings control how you use it in a cost estimate, including whether the cost component is relevant to update the material master.

Figure 1: Cost Component Configuration

Each highlighted item in Figure 1 defines a category of cost.

You can assign a cost component to more than one category, except the Cost of Goods Sold which defines one of two categories. Accounts assigned to this cost component can be for Cost of Goods Manufactured, or Sales and Administrative Costs, or Not Relevant.

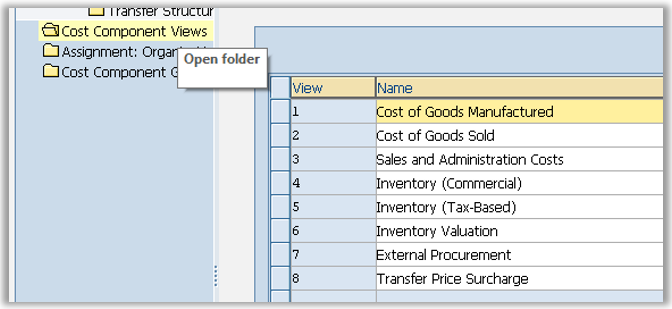

Figure 2: Cost Component Views Configuration

A new SAP implementation has eight pre-configured views, as shown in Figure 2. You can define more.

Figure 3: Cost Category Assignment to Cost Component Views

Cost of Goods Manufactured is selected in the Cost of Goods Manufactured Cost Component View in Figure 3. You can assign one or more categories to a cost component view.

For example, the Cost of Goods Sold cost component view combines Costs of Goods Manufactured and Sales and Administrative Costs.

When you create a cost estimate, up to five Cost Component Views are displayed, as shown in Figure 4. The costs displayed for each view are the cumulative values of the cost components in the cost estimate. You display the costs in a view by selecting one.

Figure 4: Cost Component Views in a Cost Estimate

Multiple values are determined when you create a cost estimate. The External Procurement view, shown in Figure 4, is based on the Initial Cost Split shown in Figure 3, which represents purchasing costs when you correctly define the cost components.

At my previous company, we configured all cost components the same and missed the additional information easily obtained. For example, although we were interested in the purchasing costs of our product, we missed what the External Procurement view could do for us. We could have also more easily accounted for transfer pricing by setting up the Transfer Price Surcharge cost category.

You can change the cost component definitions and see the results immediately in cost estimates. The costs for each cost component view are created dynamically when you view a cost estimate with CK13N.

You can update material master fields with the cost estimate. In addition to the standard price you can update three commercial prices and three tax-based prices in the Accounting 2 view. You can also update Planned Price fields in the Costing 2 view. You can only update the Standard Price with the Inventory Valuation cost category.

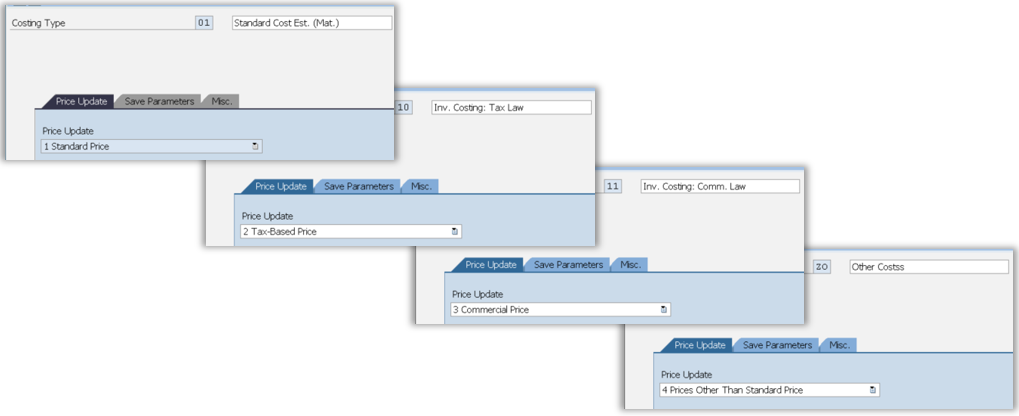

Figure 5: Costing Type Price Update

The Price Update field in the Costing Type shown in Figure 5 defines which material master fields you can update with the Costing Variant. The possible entries are No Update, Standard Price, Tax-based Price, Commercial Price, and Prices Other Than Standard Price.

Commercial and Tax-based price updates contain determination of lowest value logic. Commercial Inventory prices can only be updated from the Commercial Inventory cost component view. Tax-based Inventory prices can only be updated from the Tax-based Inventory cost component view.

Costing types defined as Prices Other than Standard Price update the Planned Price fields in the Costing 2 view and the Commercial and Tax-based Inventory fields in the Accounting 2 view.

To set up your SAP Cost Components correctly our ERPCorp SAP experts are available to assist you.

Only the Commercial Inventory view can update the Commercial Inventory fields, and only the Tax-based Inventory view can update the Tax-based fields. The determination of lowest value logic is ignored for costing types with this price update definition, and the value defined in the cost estimate is always used for these fields.

The costs associated with Planned Price 1, Planned Price 2, and Planned Price 3 can be assigned to costs of any cost component view. You can use these fields to store alternate cost component view prices.

You specify the cost component view when you perform a price update with transaction CK24, as shown in Figure 6. Since the costs for all cost component views are generated for each cost estimate, all nine fields can be updated simultaneously. You use Transaction CK24 to Mark and Release the standard price and update other prices by selecting the options in the Update Prices in Material Master Record section shown in Figure 6.

Figure 6: Price update with Prices Other than Standard Price

The correct setup of cost component views is an important feature of product costing that can be overlooked in some initial implementations. At least, this was the case in ours.

Please continue to take advantage of learning opportunities and study how cost component views can provide you with more detailed costing information.

For the latest updates

Comments