By Paul Ovigele

When you are using SAP Controlling Profitability Analysis (CO-PA), you know that mapping objects to value fields is the key to ensuring that the reports are complete and accurate. The standard scenario involves assigning amount fields, such as sales conditions, general ledger accounts, and production variances.

However, it is also important to map quantity fields, such as sales and production quantities, to value fields (which are set up with a quantity attribute in transaction KEA6). Most sales and contribution margin reports include these quantity values (for example, the Net Weight of products sold) to provide the appropriate context for the reported revenue and cost of sales figures.

There are three main areas where you can assign quantities to fields in CO-PA.

Table of Contents

Join us at SAP Controlling Financials Conference:

Meet Paul Ovigele and other SAP expert speakers in-person:

CLICK HERE

1. Assigning Quantity fields from Sales Documents

This is the most common assignment, because most of the postings in CO-PA come from sales documents. You will therefore want to map the sales quantity that led to the revenue postings from billing documents or sales orders (if you have activated Transfer of Incoming Sales Orders using transaction KEKF) by going to transaction KE4M or by accessing the following configuration menu path:

Controlling - Profitability Analysis - Flows of Actual Values - Transfer of Incoming Sales Orders - Assign Quantity Fields or Controlling - Profitability Analysis - Flows of Actual Values - Transfer of Billing Documents - Assign Quantity Fields

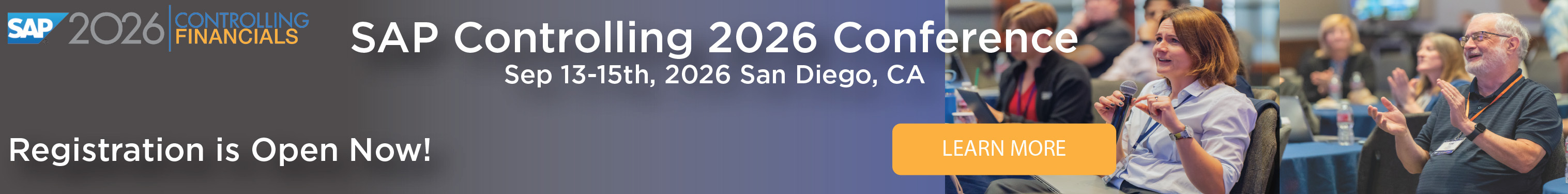

In the next screen, click on New Entries and enter the sales quantity fields and the corresponding value fields that you want to map them to, as shown in Figure 1.

Figure 1 Assign SD Qty Fields to CO-PA Qty Fields

Anytime you post a sales document, the sales quantities will be updated in CO-PA.

2. Assigning Quantity Fields from Manufacturing Orders

When you produce a product using production orders, process orders, product cost collectors, etc., you can transfer the quantity produced to CO-PA by going to transaction KEI1 or via the configuration menu path:

Controlling - Profitability Analysis - Flows of Actual Values - Settlement of Production Variances - Define PA Transfer Structure for Variance Settlement

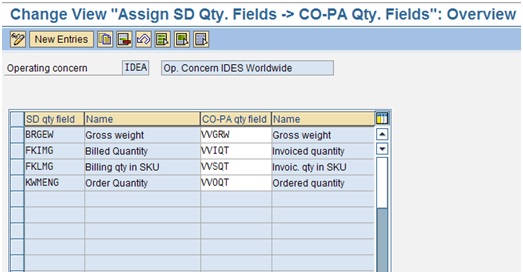

Click on the relevant PA Transfer Structure (which is assigned to the settlement structure of the order type) and double-click on the Assignment Lines folder. Then enter an assignment number, a description and click on the Qty billed/delivered checkbox as shown in Figure 2.

Figure 2 Define PA Transfer Structure

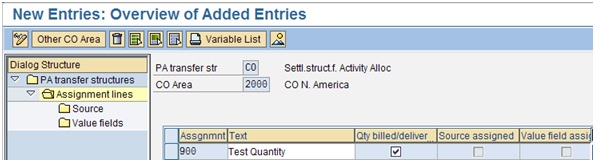

Then, double-click on the Value Fields folder and select Quantity Field; enter ?3? in the Fixed/Variable column and enter the relevant quantity value field as shown in Figure 3.

Figure 3 Quantity Fields

Figure 3 Quantity Fields

Anytime you settle the manufacturing order, which has been delivered or technically completed, the quantity of the order will be passed to CO.

To learn more about SAP FICO topics, become a member by clicking here:

3. Assigning Quantity Fields from FI Documents

There are times when you need to post manual FI documents to CO-PA (for example, using transaction FB50 or FB70) and you want the quantities that you enter in this transaction to flow to CO-PA (note, you would need to enter the relevant quantity and unit of measure in the Qty and Base Unit of Meas. Columns of these transactions). You can do this by going to transaction KEI1 or via the configuration menu path:

Controlling - Profitability Analysis - Flows of Actual Values - Direct Posting from FI/MM - Maintain PA Transfer Structure for FI Postings

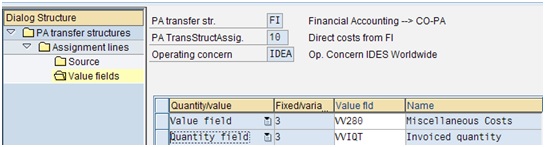

Highlight the relevant PA transfer structure (configured in Transaction KEVG6) and double-click on the Assignment Lines folder. You have already assigned the appropriate cost elements to the Amount value fields. Therefore, simply select the assignment line that contains the cost elements and double-click on the Value Fields folder. Then select Quantity Field; enter 3 in the Fixed/Variable column and enter the relevant quantity value field as shown in Figure 4.

Figure 4 Define PA Transfer Structure

Anytime you make a posting to the relevant general ledger account and enter a quantity and unit of measure, this quantity will be passed to CO-PA.

Glossary

Activity Type

An activity type identifies activities provided by a cost center to manufacturing orders. The secondary cost element associated with an activity type identifies the activity costs on cost center and detailed reports.

Actual Costing

Actual costing determines what portion of the variance is debited to the next-highest level using material consumption. All purchasing and manufacturing difference postings are allocated upward through the BOM to assemblies and finished goods. Variances can be rolled up over multiple production levels to the finished product.

Assembly Scrap

Assembly Scrap allows you to plan for faulty or damaged assemblies.

Since no production process is perfect, some scrap is always produced. You can either scrap or rework assemblies and components that do not meet quality standards. Depending on the problem, you may scrap cheaper items and rework costly items.

Automatic Account Assignment

Automatic account assignment allows you to enter a default cost center per cost element within a plant with Transaction OKB9.

Condition Type

A condition type is a key that identifies a condition. The condition type indicates, for example, whether the system applies a price, a discount, a surcharge, or some other pricing, such as freight costs and sales taxes.

Cost Center Accounting

A cost center is a function within an organization that does not directly add to profit but still costs money to operate, such as the accounting, HR, or IT departments. The main use of a cost center is to track actual expenses for comparison to the budget.

Cost Estimate

A cost estimate calculates the plan cost to manufacture a product or purchase a component. It determines material costs by multiplying BOM quantities by the standard price, labor costs by multiplying operation standard quantities by plan activity price, and overhead values by costing sheet configuration.

Cost Object

An SAP Cost object such as a cost center or internal order describes where the cost occurs. A cost element or account describes what the cost is.

Costing Lot Size

The costing lot size in the Costing 1 view determines the quantity cost estimate calculations are based on. The costing lot size should be set as close as possible to actual purchase and production quantities to reduce lot size variance.

Goods Issue

A goods issue is the movement (removal) of goods or materials from inventory to manufacturing or a customer. When goods are issued, it reduces the number of stock in the warehouse.

Goods Receipt

It is a goods movement used to post goods received from external suppliers or in-plant production. All goods receipts result in an increase of stock in the warehouse.

Component Scrap

Component scrap refers to the percentage of a component's quantity that does not meet the required quality standards before being inserted into the production process. The planned amount of components is increased. Component scrap is an input scrap because it is detected before use in the production process. You plan component scrap in the MRP 4 view and the Basic Data tab of the BOM item. An entry in the BOM Item field takes priority over an entry in the MRP 4 view.

GRIR

SAP Goods Receipt Invoice Receipt performs a three-way match between the purchase order, goods receipt, and invoice receipt.

You use the GR/IR clearing account to record the offset of the GR and IR.

Internal Order

An internal order monitors the costs and revenue of an organization for short- to medium-term jobs. You can plan at a detailed level and budget at an overall level, with availability control.

Material Master

A material master contains all of the information required to manage a material. Information is stored in views, and each view corresponds to a department or area of business responsibility. These views conveniently group information together for users in different departments, such as sales and purchasing.

Order Type

The order Type categorizes orders according to their purpose and allows you to allocate different number ranges and settlement profiles.

Origin Group

An origin group separately identifies materials assigned to the same cost element, allowing them to be transferred to separate cost components. The origin group can also determine the calculation base for overhead in costing sheets.

Profitability Analysis

Profitability Analysis enables you to evaluate market segments, which can be classified according to products, customers, orders (or any combination of these), or strategic business units, such as sales organizations or business areas, with respect to your company's profit or contribution margin.

PA Transfer Structure

A PA transfer structure allows you to assign costs and revenues from other modules to value and quantity fields in Profitability Analysis.

Price Control

The Price control field in the Costing 2 view determines whether inventory is valuated at standard or moving average price.

Price Unit

The price unit refers to the number of units to which the price applies. You can increase the accuracy of the price by increasing the price unit. To determine the unit price, divide the price by the price unit.

Process Order

Process orders are used for the production of materials or the provision of services in a certain quantity and on a certain date. They enable the specification of resource planning, process order management control, account assignment, and order settlement rules.

Join us at SAP Controlling Financials Conference:

Meet Paul Ovigele and other SAP expert speakers in-person: CLICK HERE